The dual opportunities of PVC demand growth and production capacity gap in the Indian market for China's raw material exports and second-hand equipment entry

ONE. Specific cases of Chinese enterprises successfully entering the Indian market

Case: A well-known Chinese PVC pipe manufacturer successfully expanded into the Indian market

A large Chinese PVC pipe manufacturer (hereinafter referred to as " Liansu ") reached out to Indian customers through the IndiaMart platform in 2018 and launched customized PVC-U pipe products to meet India's agricultural irrigation and infrastructure needs. Liansu has rapidly risen in the Indian market through the following strategies:

- Product localization adaptation: In view of the climate characteristics of India, we developed high temperature resistant and UV resistant PVC pipes to extend their service life and meet the needs of agricultural irrigation scenarios;

- Balance between price and quality: Taking advantage of the cost advantage of Chinese manufacturing, we provide PVC pipes with a higher cost-performance ratio than local Indian products, while ensuring quality through ISO certification;

- Channel cooperation and after-sales network: Cooperate with local dealers in India to establish a sales network covering major agricultural areas and set up after-sales service centers to solve customers' installation and maintenance pain points;

- Policy response: During the period of fluctuations in India’s anti-dumping policy, reduce tariff risks by adjusting the export structure (increasing the proportion of high value-added products) and establishing joint production with local companies.

As of 2024 , Lesso 's market share in India has reached 15%, making it one of the top three suppliers in the agricultural irrigation pipe field. It has successfully verified the effectiveness of the "product customization + channel sinking + flexible policy response" model in the Indian market, providing a replicable path for other Chinese companies.

TWO. Analysis of hot-selling PVC-related products in the Indian market

Based on IndiaMart platform transaction data and China's export growth trend, the Indian market PVC demand presents the following core hot-selling products:

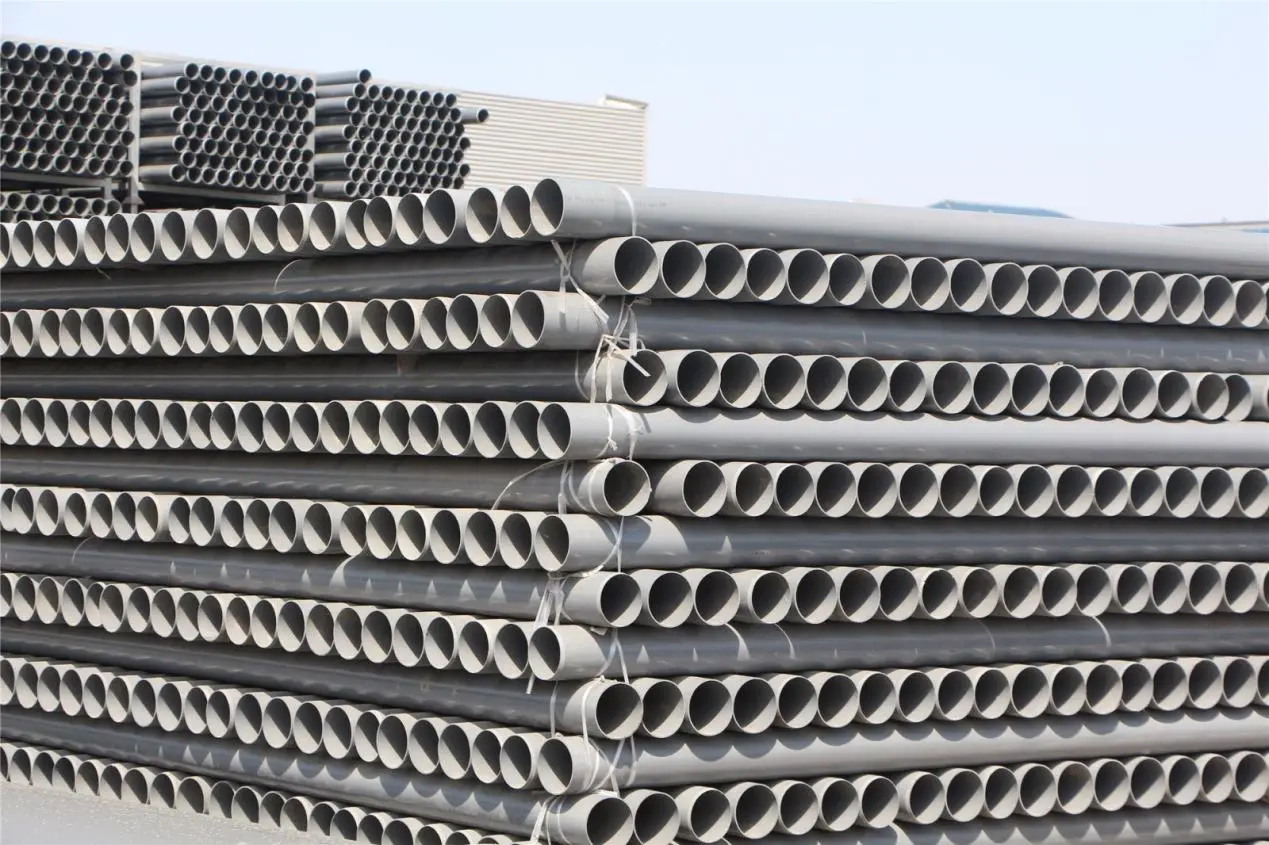

- PVC pipes for agriculture

- Demand driver: India's agricultural irrigation and rural water supply projects continue to expand, accounting for 66% of total PVC demand.

- Hot-selling categories: large-diameter irrigation pipes (diameter ≥ 200mm), low-pressure drainage pipes (PVC-U material), with transaction volume increasing by more than 20% year-on-year.

- Features: Weather resistance, corrosion resistance, lightweight design and low cost are the core considerations for purchasing.

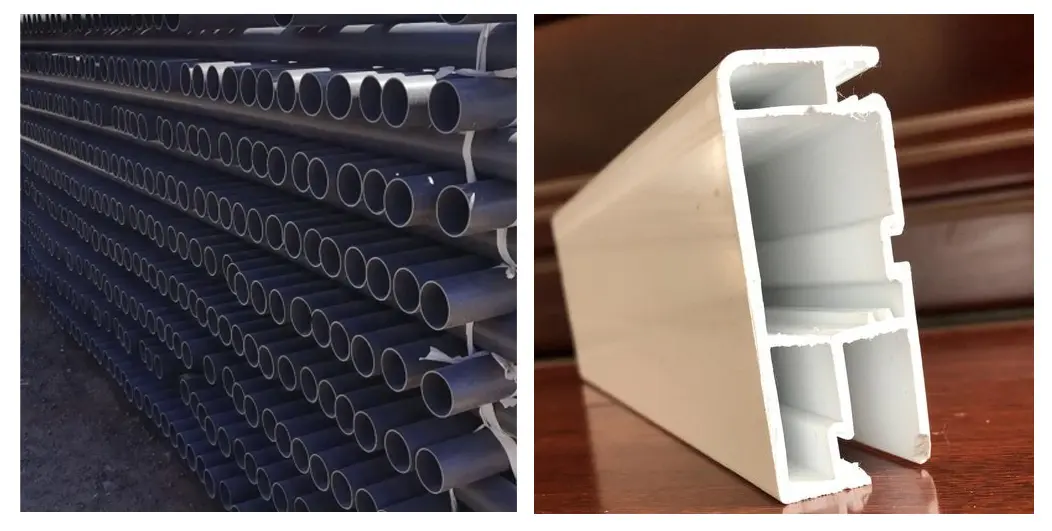

- Products related to the construction field

- Building profiles: The demand for PVC-U door and window frames and wall panels is growing as India's urbanization progresses, and the penetration rate of co-extruded foam profiles (energy-saving doors and windows) in the high-end market is increasing.

- Flooring materials: SPC flooring (stone plastic composite flooring) and PVC roll flooring are rapidly becoming popular in commercial buildings and home decoration, and products with environmental certification (such as E0 grade) are more popular.

- Waterproof materials: PVC waterproof membranes are widely used in roof and basement waterproofing projects. Platform transaction data shows that buyers are mostly concentrated in construction contractors.

- Wire and cable sheath

- Demand for power upgrade: India's power grid transformation and urbanization electrification have driven a surge in demand for PVC sheath materials for medium and low voltage cables.

- Trend: Although low-smoke zero-halogen (LSZH) environmentally friendly PVC cable materials account for less than 20%, the growth rate is 30%, reflecting India's gradual improvement in safety and environmental standards.

- Packaging and soft products

- Films and soft bags: The demand for transparent PVC films and agricultural covering films for food packaging is stable, and the demand for soft PVC products such as medical infusion bags is growing with the development of India's pharmaceutical industry.

- Injection molded products: The demand for injection molded parts such as toys and electrical accessories is scattered, but small and medium-sized enterprises have frequent orders, which is suitable for flexible production models.

THREE. Opportunities of second-hand PVC processing machinery in the Indian market

India's domestic PVC production capacity gap (capacity of 1.57 million tons in 2022, demand of 4.57 million tons) and the rapid expansion of small and medium-sized enterprises have brought significant opportunities for second-hand processing machinery:

- Core Requirement Equipment

- Extrusion lines: Second-hand PVC pipe/profile extruders (mainly small and medium-sized production capacity), with high demand for supporting molds and cooling systems.

- Injection molding machinery: economical second-hand injection molding machines (clamping force 100-300 tons) suitable for the production of pipe fittings and accessories.

- Calendering and film equipment: low- and medium-end PVC film production lines (calenders, slitters) are suitable for packaging and flooring roll processing.

- Recycling machinery: Driven by India's environmental protection policies, second-hand PVC waste granulation machines have become an emerging demand.

- Opportunities and Challenges

- Chance:

- Indian SMEs prefer low-cost equipment to quickly start production;

- China's second-hand equipment technology is mature and the supply of repair parts is sufficient;

- Production line + technical guidance can be sold as a package to enhance competitiveness.

- challenge:

- Changes in India’s tariff policy (import tariffs on second-hand equipment can reach 15%-20%);

- The equipment transportation and installation costs are high;

- It is necessary to establish a local after-sales service network to avoid losing customers due to technical problems.

- Prospects of China's exports of PVC and processing machinery to India

Combining case experience with market trends, the future prospects can be analyzed in stages:

- Short-term (1-3 years)

- PVC raw material exports: Benefiting from India's infrastructure demand and capacity gap, China's exports of low-priced PVC raw materials (especially general-purpose SG-5) may maintain an annual growth rate of more than 10%, but we need to be vigilant about fluctuations in anti-dumping tariffs.

- Second-hand equipment window period: The expansion demand of small and medium-sized enterprises in India drives the export of second-hand extruders and injection molding machines, with a focus on supporting equipment in the fields of agricultural irrigation and building profiles.

- Risks: global PVC price fluctuations and local policy uncertainty in India.

- Medium to long term (3-5 years)

- Product upgrading and differentiation: China can expand exports of high value-added PVC products (such as modified PVC and environmentally friendly cable materials) to match the needs of the Indian high-end market.

- Transformation of equipment exports: from second-hand equipment to technical cooperation, complete turnkey projects, or participation in local capacity expansion projects in India.

- Green compliance: India's ESG standards are becoming stricter, and environmentally friendly PVC and recycling equipment will become a new growth point for exports.

- Localized production: Setting up joint ventures or acquiring small and medium-sized production capacity in India to avoid tariffs and get closer to the market.

- Strategic recommendations

- Deeply cultivate B2B platforms: Use platforms such as IndiaMart to accurately connect with buyers and provide customized solutions.

- Value-added services: Building a local service team in India to provide full life cycle services including equipment installation, technical training, and spare parts supply.

- Compliance response: Follow India's anti-dumping policy and flexibly adjust the export structure (such as increasing the proportion of high value-added products) or adopt the re-export trade model.

- Green technology cooperation: jointly develop environmentally friendly PVC formulas or recycling technologies with Indian companies to meet India's sustainable development goals.

In conclusion

The growth in PVC demand and the capacity gap in the Indian market provide Chinese companies with dual opportunities to export raw materials and enter the market with second-hand equipment. Through the strategy of "localized products + service delivery + flexible policy response", Chinese companies can seize the low-cost advantage in the short term, transform to high value-added areas in the medium and long term, and continue to tap the potential of the Indian market. The successful case of Liansu Company has confirmed the feasibility of this path. In the future, it is necessary to adjust the strategy in line with market dynamics and balance risks and opportunities.