Analysis of Vietnam supply chain trends after Chinese cable industry manufacturers flocked to Vietnam

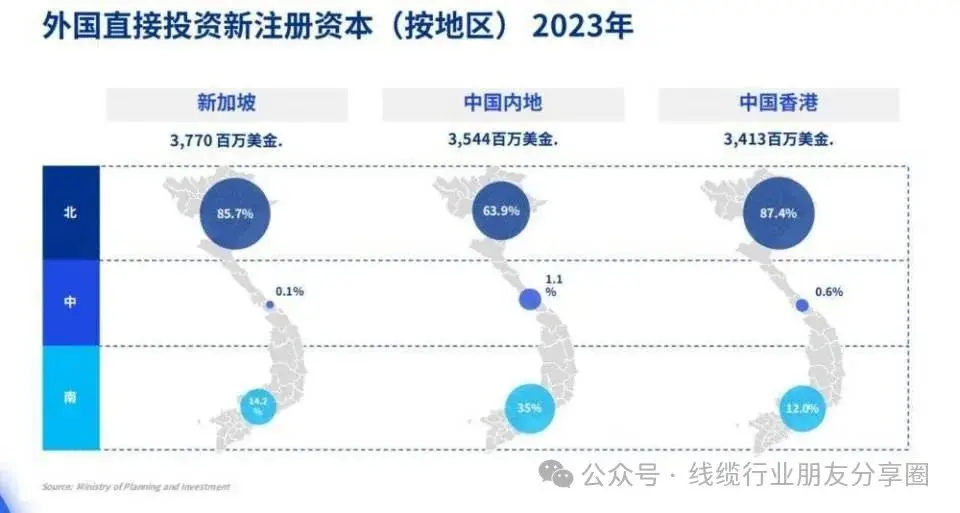

But if you want to invest and build a factory overseas, Vietnam has become a hot spot. Vietnam in 2024 is very lively. In the first quarter of 2024, Vietnam's foreign direct investment (FDI) reached 6.17 billion US dollars, a new high, an increase of 13.4% year-on-year, and a fierce momentum. Among them, the most active are the companies pouring in from China. Although according to statistics from the Ministry of Investment and Development of Vietnam, in the newly registered capital of foreign direct investment in 2023, funds from mainland China ranked only second (US$3.544 billion, first for Singapore at US$3.77 billion, and third for Hong Kong, China at US$3.413 billion), many investments from mainland China are made through Singapore and Hong Kong, China. Regardless of the number or total amount, China's investment in Vietnam is undoubtedly ranked first.

Vietnam supply chain, we do not recommend

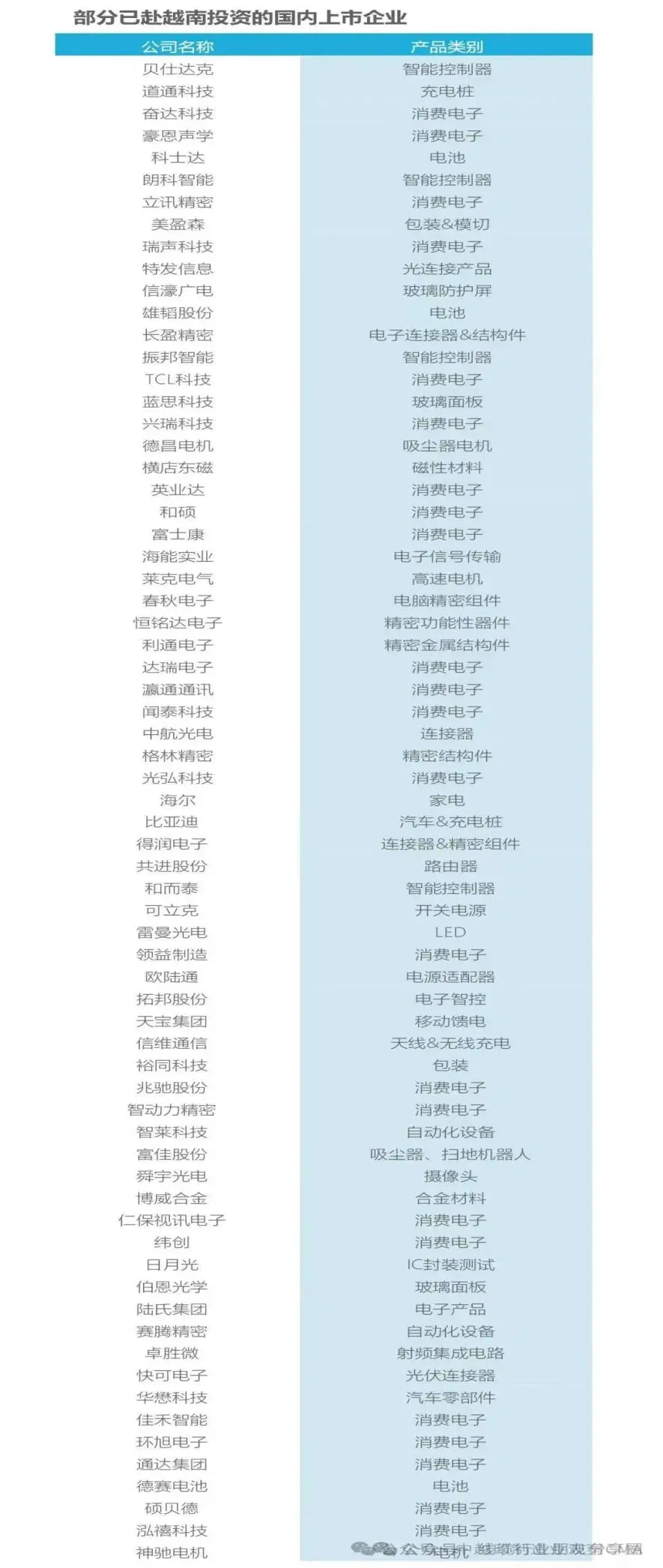

Chinese companies that did not go overseas in previous years also came out in 2024, especially those with a large share of the US market. "According to our understanding, more than 300 Chinese listed companies have established production bases in Vietnam, and there are more than 3,000 listed companies in China's manufacturing industry. The reasons why Chinese companies are flocking to Vietnam are not complicated. The most important factor is to avoid high tariffs. "For most industries, the tariff difference between exports from China and Vietnam to the United States is 20%-25%. Some products even have double anti-dumping tariffs (anti-dumping and anti-subsidy tariffs) on China. Another reason is that compared with other popular low-tariff areas such as Mexico and Brazil, Vietnam's comprehensive cost is still relatively low. "Brazil's manufacturing and procurement costs are 3-4 times that of Vietnam, and Mexico often has problems with scarce raw materials, immature technology and low production efficiency.

Of course, the most important reason why a large number of Chinese companies choose to flock to Vietnam this year is to prevent the escalation of Sino-US trade friction. Trump's re-election has reminded many Chinese companies of the difficult times during the Sino-US trade war in 2018. 2018 was the first time that Chinese companies invested heavily in building factories in Vietnam. "Before, I took the initiative to go to Vietnam to look for opportunities, but now I am 'forced' to come out." A senior industry insider who has been rooted in the Vietnamese market for ten years lamented. Various issues such as trade friction, tariffs, and origin requirements surround Chinese companies, and they urgently need to find a registration. As large cable supply chain companies such as Foxconn and Luxshare Precision have moved their production lines to Vietnam, the migration of the cable supply chain manufacturing industry has entered a small peak. The transfer of factories from Japan and South Korea has almost been completed, and Taiwan-funded enterprises are gradually arriving. The northern ones are mainly concentrated in Bac Ninh, Bac Giang, Hai Phong, Hai Duong, Taiping and Nam Dinh; the southern ones are mainly concentrated in Ping Duang, Tong Nai, Vung Tau, etc. cities, while in the central region there are many large companies building industrial zones on their own . The Vietnamese government is actively promoting the construction of roads, electricity and other infrastructure, and the North-South Expressway will soon be opened to traffic. In the north, it runs from Lao Cai to Hanoi and then to Vinh City in Nghe An. In the middle, the old Ho Chi Minh Road has been widened. In the south, you can go directly from Ho Chi Minh City to Nha Trang (from Nha Trang to the north, you mainly rely on the widened Ho Chi Minh Road). Therefore, recent changes in Vietnam have been rapid and significant indeed. Although many small factories also hope to participate, currently it is mainly large enterprises or their supporting factories that have settled in, and these enterprises already have foreign orders. For small companies without local customers, there are still certain risks and need to be carefully examined.

The current economy is: the United States uses technology (especially intellectual property rights), finance, etc. to harvest the world, and the United States' low-end and mid-end products mainly come from China. Now the trade war is to increase China's tariffs on low-end and mid-end products (which will also cause inflation in the United States). Then the low-end products exported to the United States can only be invested and set up factories outside of China! With Taiwan-funded PC manufacturers such as Compal and Asus manufacturing PC consumer electronics products for export to Dell, Google, Amazon, etc. in Vietnam, and Foxconn assembly factories continuing to reduce their scale in the mainland, it can be seen that Vietnam is really having the opportunity to become a world manufacturing center, at least a manufacturing center in the electronics field. In addition to big brands such as Samsung, Intel, and LG, more and more manufacturers of world-renowned electronic brands are also doing business in Vietnam. Vietnam has become a production base for electronic products and mobile devices. After understanding, it is found that many cables and cable-related peers have already taken root in the local area.

The more famous ones in the industry, such as Foxconn, Haineng, Luxshare, Yongbao, Kelixin, Chaoyang, Xinlang, Yingtong, Derun, Eurolink, Haoende, Changying Precision, AVIC Optoelectronics, Hongsheng Precision, Wanma Cable, Wantai Wire, etc., have already laid out and achieved results. With Trump's upcoming inauguration and related high-quality customers represented by Apple also starting to go to the Chinese supply chain, Foxconn and Luxshare Vietnam are trial-producing Apple Watch and MacBook. The country's industrialization and mechanization are accelerating, and the manufacturing industry dominated by electronic products and textiles and clothing is developing rapidly. The increasingly large export volume has significantly boosted the country's economic development. The continued growth of foreign investment will also promote Vietnam's development at a faster pace. At this stage, due to the deterioration of Russia-Ukraine relations and China-US/China-EU relations, some foreign companies have begun to accelerate the transfer of some production bases and even R&D centers originally established in China to Vietnam. However, with the simultaneous entry of a large number of manufacturers, fierce competition has begun from land to labor . Everyone should be cautious when moving factories to Vietnam!