Proposal for Nylon Sheathed THHN/THWN Building Cable Production Project in the Mexican Market

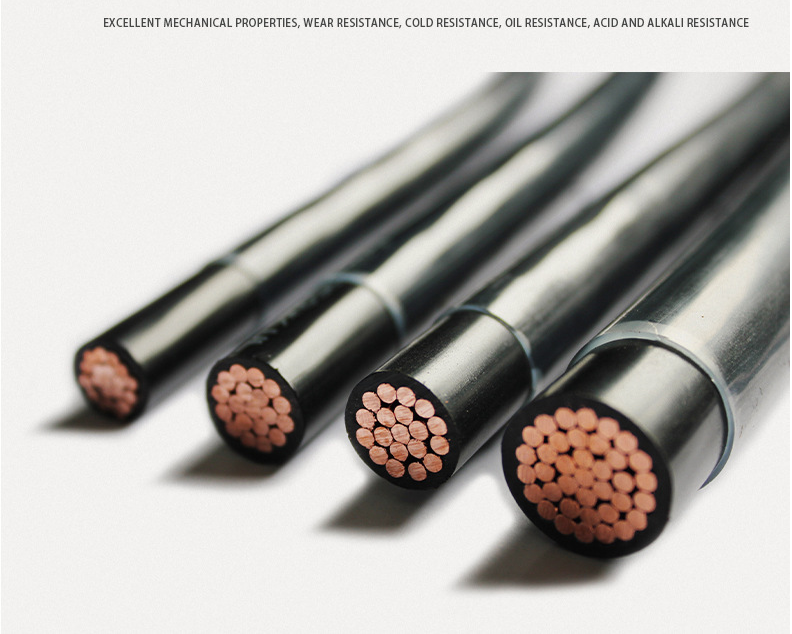

Preface:Nylon Sheathed Building Wire and Cable(THHN/THWN)

◆ Item

PVC Insulated Nylon Sheathed THHN/THWN Building Cables

◆ Structure

Conductor + Insulation + Jacket

◆ Conductor

Copper

◆ Insulation/Jacket Material

PVC/Nylon

◆ Insulation Color

Red/Black/Customized

◆ Nominal Voltage

450/750V

◆Application

THHN/THWN cable is a very popular type of building wire used in all types of industrial, commercial and residential construction.

◆Specification Table

|

AWG Size |

Nominal Section |

No. / Dia of Conductor |

Insulation Thickness |

Nylon Thickness |

Overall Dia |

|

20 |

0.519 |

1X0.813 |

0.38 |

0.10 |

1.77 |

|

18 |

0.823 |

1X1.020 |

0.38 |

0.10 |

1.98 |

|

16 |

1.310 |

1X1.290 |

0.38 |

0.10 |

2.25 |

|

14 |

2.080 |

1X1.630 |

0.38 |

0.10 |

2.59 |

|

12 |

3.310 |

1X2.050 |

0.38 |

0.10 |

3.01 |

|

10 |

5.260 |

1X2.590 |

0.51 |

0.10 |

3.81 |

|

8 |

8.340 |

1X3.260 |

0.76 |

0.13 |

5.04 |

|

16 |

1.31 |

19X0.30 |

0.38 |

0.10 |

2.46 |

|

16 |

1.31 |

7X0.49 |

0.38 |

0.10 |

2.43 |

|

14 |

2.08 |

19X0.38 |

0.38 |

0.10 |

2.86 |

|

14 |

2.00 |

7X0.60 |

0.38 |

0.10 |

2.86 |

|

12 |

3.31 |

19X0.47 |

0.38 |

0.10 |

3.32 |

|

12 |

3.50 |

7X0.80 |

0.38 |

0.10 |

3.36 |

|

10 |

5.26 |

19X0.60 |

0.51 |

0.10 |

4.22 |

|

10 |

5.50 |

7X1.00 |

0.51 |

0.10 |

4.22 |

|

8 |

8.37 |

19X0.75 |

0.76 |

0.13 |

5.53 |

|

8 |

8.37 |

7X1.23 |

0.76 |

0.13 |

5.47 |

|

6 |

13.30 |

19X0.95 |

0.76 |

0.13 |

6.53 |

|

6 |

13.30 |

7X1.55 |

0.76 |

0.13 |

6.43 |

|

4 |

21.15 |

19X1.19 |

1.02 |

0.15 |

8.29 |

|

4 |

21.15 |

7X1.96 |

1.02 |

0.15 |

8.22 |

|

2 |

33.62 |

19X1.50 |

1.02 |

0.15 |

9.84 |

|

2 |

33.62 |

7X2.47 |

1.02 |

0.15 |

9.75 |

|

0 |

42.36 |

19X1.69 |

1.27 |

0.18 |

11.35 |

|

0 |

42.36 |

7X2.78 |

1.27 |

0.18 |

11.24 |

|

1/0 |

53.49 |

19X1.89 |

1.27 |

0.18 |

12.35 |

|

2/0 |

67.43 |

19X2.12 |

1.27 |

0.18 |

13.50 |

|

3/0 |

85.01 |

19X2.39 |

1.27 |

0.18 |

14.85 |

|

4/0 |

107.20 |

19X2.68 |

1.27 |

0.18 |

16.30 |

|

250 |

127.00 |

37X2.09 |

1.52 |

0.20 |

18.07 |

|

300 |

152.00 |

37X2.29 |

1.52 |

0.20 |

19.47 |

|

350 |

177.00 |

37X2.47 |

1.52 |

0.20 |

20.73 |

Part One: Project Background and Market Analysis

1.Increased demand for building cables in Mexico

-The construction industry in Mexico is the core engine of the economy, with offshore outsourcing driving infrastructure expansion. The construction industry is expected to grow by 5.2% in 2025.

-The demand for building cables is concentrated in residential, commercial, and industrial projects, and nylon sheathed wires have become mainstream due to their wear resistance and oil pollution resistance, especially in high temperature and dusty environments.

-The Mexican government promotes sustainable buildings by requiring cables to comply with environmental standards (such as RoHS) and local production.

2.Policy and tariff environment

-Mexico and the United States have reached a tariff extension agreement until April 2025, but localized production can avoid potential tariff risks and comply with new RFC regulations (requiring local bank accounts and RFC registration).

-Building cables need to pass NMX-J-521-ANCE certification, and UL certification can be applied for simultaneously to cover the North American market.

Part TWO: Technical Solutions and Product Design

1.Core process of nylon sheath tandemco-extrudingline

-Double layer insulation tandem co-extrusion process:

-Inner layer: polyvinyl chloride (PVC), temperature resistant to 90 ℃; Outer layer: PA nylon sheath, temperature resistance of 105 ℃, tensile strength ≥ 20MPa.

-Compatible with Mexican building standards (such as NMX-J-521), supporting conductor cross-sections of 1.5-35mm ², covering residential and industrial scenes.

-High speed extrusion and precise control:

We adopt an E-DF90/35+70PA tandem co-extruder production line (extrusion rate of 280kg/h, line speed of MAX 150m/min, screw aspect ratio of 30:1, PID temperature control ± 1 ℃) to ensure the uniformity of the protective cover thickness (error ± 0.05mm).

2.Environmental protection and energy-saving design

-Halogen free flame retardant nylon material (LSZH), compliant with the Mexican IS 10810 low smoke standard; Production line energy consumption ≤ 0.8kWh/km, compatible with Mexico's "Free Electricity Plan".

Part Three: Specification and Configuration for Double or Three Layer Insulation Co-extruding Line

2.Technical specifications of core equipment

① Main extruder (color strip): screw diameter Φ 90+35mm (PVC), BM type screw, aspect ratio 30:1, temperature control section 7+6

② Co-extrusion system: double-layer/three-layer tandem extrusion cross- head and die、tip, suitable for wire diameter of Φ 5-25mm, supports rapid mold change (<20 minutes)

③ Cooling system: double-layer U-shaped water cooling tank (segmented cooling control), air-cooled unit (temperature fluctuation ± 2 ℃)

④ Control system: Siemens S7-1500 PLC integrated laser caliper, real-time monitoring of thickness and eccentricity

⑤ Cable winding system: PN1000-PN2000 power cable winding+double axis cable winding (tension control ± 5N)

2.Localized adaptation configuration

① Raw materials: locally supplied PVC and PA particles from Mexico, compliant with NMX-J-521 flame retardant requirements and BIS/NCE certification

② Testing equipment: Online pressure tester (2500V/5-minute immersion test)+smoke density detector (IS 10810) calibrated in local laboratory

③ Environmental Certification: RoHS Compliance Report+Mexico SEMARNAT Environmental Filing Mandatory Access Requirements

Part Four: Supply Chain and Cost Planning

1.Localized production strategy

-Raw material procurement: Prioritize cooperation with local suppliers in Mexico to reduce logistics costs by 25%.

-Equipment maintenance: Establish a technical service center in Mexico City to provide spare parts reserves and rapid response.

2.Investment and return analysis

① Total equipment investment: 3.5-4 billion rupees (including tariff exemptions), eligible for Mexican manufacturing subsidies (PLI program)

② Unit production cost: 1.2-1.5 million rupees per kilometer, including local raw materials and energy consumption. Annual output value (full production): 18-20 billion rupees, calculated based on the average price of 150000 rupees per kilometer in the Mexican market

④ Investment payback period: 4-5 years, with an annual profit margin of approximately 20-25%

Part Five, Risks and Response Measures

1.Policy risk

-The Mexican RFC tax regulations require local bank accounts, and it is recommended to cooperate with BBVA Bancomer to open accounts and avoid 16% value-added tax withholding.

2.Market competition

-Chinese cable companies such as Tongding Optoelectronics have entered the Mexican market and can establish advantages through differentiated products (customized flame retardant grades).

3.Supply chain fluctuations

-Reserve key spare parts (such as BM screw components) and sign redundancy agreements with US suppliers to prevent geopolitical impacts.

Part SIX, Suggestions for Project Implementation

1,Priority location:

Industrial areas in Monterey or Mexico City, close to the concentration of construction projects, with logistics cost optimization of 30%.

2,Market promotion:

Participate in Wire Mexico 2025 and connect with local builders and distributors.

3,Technical cooperation:

Jointly establish a research and development center with the National Autonomous University of Mexico (UNAM) to develop high-temperature resistant nylon materials (suitable for desert climates).

**Note * *: The above plan needs to be combined with localization testing and policy adjustments in Mexico. It is recommended to apply for UL certification simultaneously to cover the North American market.