Important technological advances and research hotspots in the cable industry in 2024

Breakthroughs in key materials and process equipment

Materials are known as the cornerstone of cable technology innovation. Insulation and sheath materials, key process equipment, etc. in the field of cable materials have long been controlled by others. Industry leaders represented by Shanghai Cable Research Institute Co., Ltd. have leveraged their own advantages, pioneered innovation, and provided new ideas for solving this "bottleneck" technical problem.

Hengyang Cable Co., Ltd. has developed a ceramic silicone rubber fire-resistant cable material . Ceramic silicone rubber fire-resistant cable is a new material cable used in the electrical field. When exposed to flames, the cable can form a structurally stable, dense and non-combustible ceramic layer to effectively protect the internal core and materials.

Hengyang Cable Co., Ltd. used cone calorimeter, thermogravimetric analyzer and thermal insulation performance test to analyze the combustion performance and pyrolysis characteristics of ceramic silicone rubber, and combined muffle furnace and Fourier transform infrared spectroscopy to study the evolution of the ceramic layer of ceramic silicone rubber cable during the combustion process.

The results show that the ceramicization process of ceramicized silicone rubber fire-resistant cable can be divided into three stages, namely the initial decomposition stage, the initial ceramicization reaction stage and the ceramicization stabilization stage. The entire ceramic body stage is a process of first releasing heat and then absorbing heat. The cable has excellent thermal stability and thermal insulation and material isolation properties, which can effectively reduce the fire hazard of cable combustion.

Hubei Provincial Product Quality Supervision and Inspection Institute introduced the operating methods and common problems of high-temperature pressure tests. By analyzing the main factors affecting the test, it was found that when using traditional devices, the deformation of cable specimens under high temperature caused the rectangular blade to move or tilt, which was one of the main factors leading to unstable data. Therefore, a new high-temperature pressure test device was designed.

The new test device and the traditional test device use different pressure-applying methods in their structures. Through the test methods and data analysis of the two devices, it is proved that the new high-temperature pressure test device meets the standard requirements and the test data reliability requirements. The new test device is easy to operate, which improves the situation of tool dropping when the test device operator moves and replaces the weight, and improves the test efficiency.

In the third-generation advanced nuclear power plant demonstration reactor project (CAP series), some specific areas such as special cables for electric heaters have strict requirements. In addition to the conventional halogen-free, low smoke, single/bundled flame retardant, water-resistant and other requirements, they are also required to be able to operate for a long time at an operating temperature of 132 ℃, withstand 283 kGy of gamma ray irradiation and pass the flexibility retention test, etc. The finished products need to be imported from France or the United States in the early stage, which are expensive, have a long procurement cycle and no independent intellectual property rights. China lacks key insulation materials.

Shanghai Cable Research Institute Co., Ltd. has developed flame-retardant , high-temperature, and radiation-resistant silicone rubber for cables in nuclear power plants . The team selected different phenyl silicone rubber substrates from the perspective of high-temperature resistance and radiation resistance, studied the effects of different heat-resistant agents, hydrophobic modification additives, and flame-retardant systems on the material's high-temperature resistance, moisture resistance, and flame-retardant properties, and developed a new type of halogen-free flame-retardant, high-temperature, and radiation-resistant silicone rubber material; the electrical properties, mechanical and physical properties, combustion properties, accelerated thermal aging properties, and conventional radiation aging properties of the high-temperature cables for electric heaters prepared using it as an insulating material all meet the technical requirements, thus achieving independent control of the materials and core technologies of key components.

In response to the undesirable phenomenon caused by the "drooling" of conductor shielding and insulation shielding, Wang Fuzhi and others from Zhejiang Wanma Co., Ltd. designed a new type of ultra-high voltage cross-linked cable insulation extrusion die. Based on the principle of mold expansion, the team improved the die caliber form, thereby avoiding defects such as excessive interface protrusions caused by traditional dies and improving the applicability of three-layer co-extrusion dies.

Research on basic and common technologies

The research of basic and common technologies is the cornerstone of innovation, and its results are helpful for the industry's applied research. The lack of research on basic common technologies in the wire and cable industry has limited the improvement of key core technology breakthrough capabilities. However, in 2022, many companies and research institutes have realized the seriousness of this problem and attached importance to the research of common technologies.

The research and development teams of State Grid Suzhou Power Supply Company and Nanjing Xiesheng Intelligent Technology Co., Ltd. studied the mechanism of power cable explosion caused by ground fault: the ground fault current flows through the cable phase shielding layer for a long time. Due to the high current density, it heats up and melts the insulation material of the cable, and thermally decomposes into combustible gases, which are then ignited by the arc at the single-phase grounding fault point.

At the same time, the heating process of the power cable under the grounding fault state was analyzed, and a heat accumulation model was established. Combined with the power cable safety operation specifications, the light warning value was determined with the goal of ensuring the service life of the power cable, and the heavy warning value was determined with the goal of ensuring that no power cable flashover accidents due to grounding faults occurred. A power cable flashover monitoring and early warning system consisting of more than 300 monitoring points for a 10kV distribution network was established.

Nanjing Quanxin Transmission Technology Co., Ltd. introduced the basic overview of my country's shipbuilding wire and cable standard system, the formulation concept and technical changes of the GJB 774A-2020 general specification, and its differences from the GJB 1916-1994 that is still in use. Based on the analysis, suggestions for industry development in the stage of coexistence of standards are given, which can promote the acceleration of the formulation of single specifications, form a national military standard system for shipbuilding cables in my country with complete product coverage, relatively reasonable indicators, and a relatively complete system, and help shipbuilding cable designers, production selection and users to adopt standards accurately and timely.

Jiangsu Shangshang Cable Group Science and Technology Research Institute, Jiangsu Shangshang Cable Group Co., Ltd., and Harbin University of Science and Technology conducted a study on the "non-magnetic" stainless steel belt armor of single-core cables that is generally considered in the industry. The test results show that conventional stainless steel armor strips are not strictly non-magnetic, and the reference value of the relative magnetic permeability of the weak magnetism contained is between 1 and 3. Moreover, after repeated processing and deformation, the stainless steel strips do not show magnetic recovery phenomenon, and the relative magnetic permeability remains unchanged. Through COMSOL software simulation calculation and experimental verification, the influence of stainless steel belt armor with different relative magnetic permeabilities on the loss and current carrying capacity of single-core medium-voltage power cables was studied. The results can provide a theoretical basis for the application of single-core stainless steel armored cables.

Shanghai Guolan Testing Co., Ltd. conducted a finite element analysis on the key physical properties of three-core copper conductor armored dynamic cables commonly used in marine engineering, including their axial stiffness, torsional stiffness, and bending stiffness, and verified the analysis results through full-scale model tests. By comparing the numerical model simulation results with the test data, the inherent correlation between the theoretical model of the complex cross-section of marine cables and the actual product is demonstrated.

The test results reveal the validity of the assumptions introduced in the numerical model and the root causes of the differences. It provides theoretical support for the optimization of the key physical properties of dynamic cables in offshore engineering floating production systems, has very important guiding significance for the design, installation, operation and maintenance of marine dynamic cables, and provides a development direction for the next generation of numerical simulation software for marine dynamic cables with complex cross-sections.

Research to meet the special technical needs of new application scenarios

At present, the independent innovation capabilities of various industrial fields have been improved, and these application fields have put forward new requirements for wires and cables for electrical equipment. Products that meet the special needs of new application scenarios such as aviation and nuclear power have emerged.

As a signal transmission cable, data bus has a long history of development in communication network systems. With the rapid development of the aviation field, strict performance index requirements such as high transmission rate, high and low temperature resistance, light weight, and chemical corrosion resistance have been put forward for aviation data bus products.

Jiangsu Tongguang Electronic Cable Co., Ltd. introduced the domestic status of a 1394b data bus for aviation use . Taking the 1394b data bus with an inner conductor specification of AWG24 as an example, through the analysis and design of the structure, materials, and process of the data bus, a product that meets the use requirements has been developed. Its performance indicators have reached the level of similar foreign products. The development of this product has promoted the pace of domestic substitution of China's aviation data bus.

As cars develop towards intelligence and networking, in-vehicle Ethernet has begun to be used. Chengdu Fusi Automotive Wire Co., Ltd. introduced the operating characteristics, structural design and manufacturing process of in-vehicle Ethernet cables. In view of the problem that the longitudinal conversion loss (LCL) and longitudinal conversion transfer loss (LCTL) in the cable manufacturing are difficult to meet the standards, the key factors affecting the two indicators of LCL and LCTL, such as conductor material, processing technology, and selection of twisting machines, were discussed, and based on this, a cable with measured transmission performance data that is better than the design requirements of the indicators was developed.

CAP series pressurizer electric heater element cable is an important component of the latest domestically produced pressurizer electric heater for pressurizers of pressurizers in pressurizer reactor nuclear power plants. Shanghai Cable Research Institute Co., Ltd. selects methyl vinyl phenyl silicone rubber (PMVQ-1, PMVQ-2 and PMVQ-3), heat resistant agent, magnesium hydroxide, modified melamine cyanurate, additives, silicone resin intermediates and vulcanizing agent, platinum flame retardant and other materials, and develops silicone rubber materials as insulating materials by adjusting the proportion of each component.

After designing the cable structure, improving the production process, and controlling the structure accuracy, the sample cable was trial-produced. The voltage regulator electric heater cable is at the international advanced level in terms of technology level. In practical applications, it can meet the use requirements of the CAP series voltage regulator electric heater cable, avoiding the impact of the localization process of the overall voltage regulator equipment due to the unresolved cable problems. The cable has passed the accident condition function verification test required by CAP nuclear power, and can be generally used in possible application scenarios in CAP nuclear power plants. At the same time, it can be used in special environments with long-term high temperature and high radiation doses in similar scenarios.

Research on cutting-edge technologies

"Carbon peak" and "carbon neutrality" are the only way to achieve green development. The development of submarine cable engineering is still short, and there is still a gap in experience accumulation with international submarine cable giants. Further research is needed on some key indicators of submarine cables such as maximum length, intermediate joints, cable life, and key raw materials such as insulation and semiconductors, which is the future development trend.

Offshore wind power generation is one of the main focuses of green energy development in the world. As offshore wind farms become saturated, the construction scale of large-capacity and long-distance marine power transmission projects such as offshore wind farms and intercontinental interconnections at home and abroad is increasing. Cross-linked polyethylene (XLPE) insulated DC submarine cables with advantages such as large transmission capacity, low transmission loss and long transmission distance have been rapidly developed. The demand for high-voltage DC submarine cables will surge in the next 5 to 10 years.

At present, most of the research focuses on three-core AC submarine cables, single-core AC submarine cables and single-core DC submarine cables, and there is little research on three-core high-voltage DC submarine cables. The research and development team of Zhongtian Technology Cable Co., Ltd., Jiangsu Key Laboratory of Marine Energy and Information Transmission, and the State Key Laboratory of Electrical Insulation of Power Equipment of Xi'an Jiaotong University combined the currently mature three-core AC submarine cables and single-core DC submarine cables to design the structure of three-core high-voltage DC submarine cables, and analyzed the mechanical properties, electrical properties and laying costs of three-core DC submarine cables to provide a reference for subsequent DC submarine cable research.

The results show that the laying depth of the three-core DC submarine cable is 78% of that of the single-core DC submarine cable; under specific working conditions, the current carrying capacity of the three-core DC submarine cable during normal operation is 83% of that of the single-core DC submarine cable. In the event of a primary fault in the polarity cable, the other polarity cable can cooperate with the return cable to transmit electric energy, and the transmission capacity can reach 73% of the normal operation of the single-core submarine cable; the route width occupied by the three-core DC submarine cable is 50% of that of the single-core DC submarine cable, and the number of laying times is only 33% of that of the single-core DC submarine cable, which can reduce the laying cost and improve the utilization of marine resources.

The hot technical work that the industry is concerned about mainly focuses on basic technology or common technology, cable material product technology and process, equipment and manufacturing, etc.

Basic technology or common technology. Cable material life and application reliability evaluation; graphene application technology in cable materials ; new material products and application standardization technology; material consistency research; flame retardant materials and flame retardant synergistic technology research; rubber and plastic material energy saving and carbon reduction technology research, etc.

Cable material product technology. Research, production, promotion and application of 220kV and above ultra-clean insulation materials (AC and DC) and shielding materials; high-strength polyimide film and its composite technology (polyimide/polytetrafluoroethylene composite film); application technology of special engineering plastics, such as polyetheretherketone and polyimide extrusion-grade resin in cables; application technology of radiation cross-linked ethylene-tetrafluoroethylene copolymer and X-PVDF; development and promotion of irradiated rubber cable materials; research and development of new flame retardant systems for low-smoke halogen-free polyolefin cable materials; research on subdivided characteristics (high flame retardancy, no dripping, heat resistance, oil resistance, softness, wear resistance, crack resistance, water resistance, etc.); cost reduction technology, etc.; research and development of high-performance halogen-free flame retardant elastomer materials; research and development of thin-wall insulation and sheath materials for rail transit locomotive cables, etc.

Processes, equipment and manufacturing technologies. Localization of complete sets of high-end production equipment for cable materials; automation and intelligent technology for cable material manufacturing processes; localization of reliability assessment and surface roughness online detection equipment for high-voltage cable material manufacturing processes; rheology assessment equipment and methods for high-voltage cable materials, etc.

The factors that affect the development of cable material technology can be divided into internal factors and external factors. Internal factors generally include the choice of enterprise technology direction, the commercial value development of new technologies, the complementary and competitive technologies of upstream and downstream industries and the society as a whole required for innovation, and the attitude of enterprise system and culture towards innovation; external factors generally include the national economic and social development plan, domestic and foreign macroeconomic situation, national industrial policies and development trends of upstream and downstream related industries.

Low smoke halogen-free flame retardant

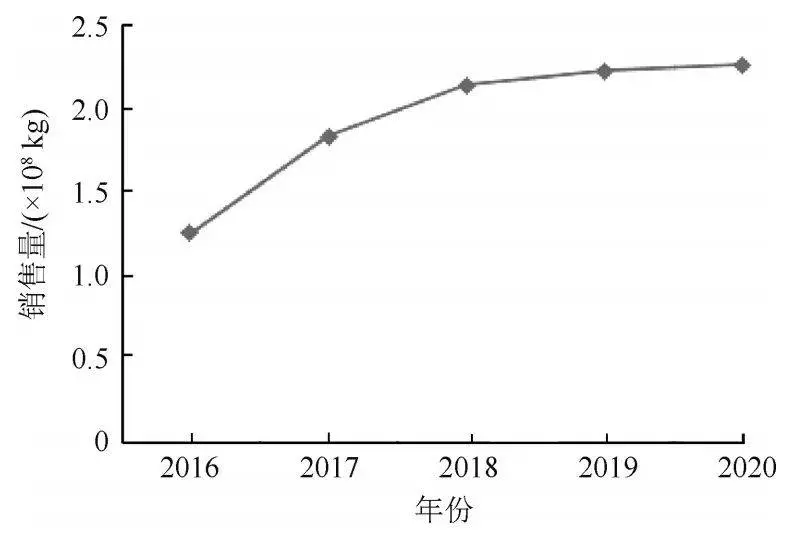

At present, low-smoke halogen-free flame retardant materials continue to develop at a high speed, and are widely promoted and applied in various fields. The overall scale has further expanded, and the comprehensive development level has been greatly improved. The national large-scale infrastructure, rail transit, new energy projects, smart grids, 5G base station construction, and broadband network infrastructure construction have accelerated, providing a good application space for materials, and also put forward higher requirements for their use environment and long-term stability. From 2016 to 2020, the sales volume of halogen-free flame retardant materials is shown in Figure 6.

Figure 6 Sales volume of halogen-free flame retardant materials from 2016 to 2020

As shown in Figure 6, the sales volume of halogen-free flame retardant materials has been increasing year by year. Market competition is concentrated on high performance and special application scenarios. Developing high-end products, differentiated competition, and occupying niche areas have gradually become the mainstream of industry development.

The application of highly flame-retardant and highly crack-resistant sheath materials for rail transit, cable materials that meet cable CPR certification or B1 (B2) grade combustion, such as B1 grade irradiation cross-linked low-smoke halogen-free flame-retardant polyolefin insulation material, B1 grade thermoplastic low-smoke halogen-free flame-retardant polyolefin sheath material, CPR grade flame-retardant and anti-adhesion sheath material for long-distance optical cables, ceramicized polyolefin insulation material and inner sheath material, demonstrates the cable material industry's strong R&D and market response capabilities.

Cross-linked polyethylene

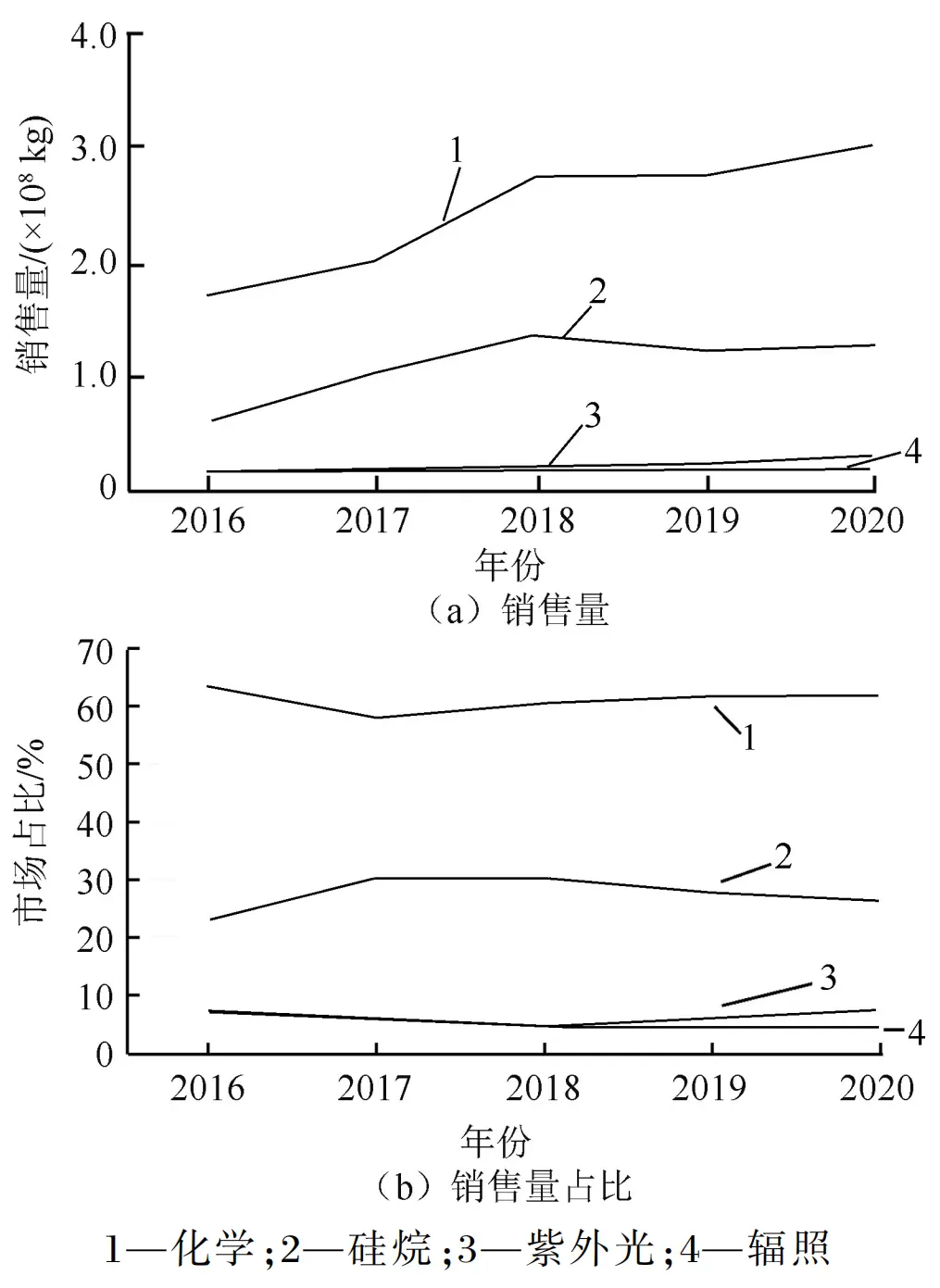

Cross-linked polyethylene insulation materials with four cross-linking methods, namely chemical cross-linking, silane cross-linking, radiation cross-linking, and UV cross-linking, have all made progress and development. From 2016 to 2020, the sales volume and proportion of cross-linked polyethylene insulation materials and sheath materials with four cross-linking methods are shown in Figure 5.

Figure 5 Sales volume and proportion of cross-linked polyethylene insulation and sheath materials with four cross-linking methods from 2016 to 2020

As shown in Figure 5, UV-crosslinked cross-linked polyethylene insulation is the fastest growing product from 2016 to 2020. UV-crosslinking technology has become mature, and its market share is gradually increasing. Many cable material companies have marketed products, with a cumulative total sales volume of 1.01x10⁹kg, which is one of the highlights of the technological development of the domestic cable material industry.

At the same time, ultraviolet light irradiation cross-linking equipment has been continuously optimized, and LED light sources are now used to replace traditional high-pressure mercury lamp light sources, which has higher production efficiency, less energy consumption, and longer life. The production cost is further reduced, and it saves an average of nearly 1,000 yuan compared to the two-step silane cross-linking polyethylene, which has compressed the market for silane cross-linked polyethylene.

Nowadays, 110kV high-voltage insulation materials have achieved mass domestic production and application. Although most of the 220kV and above ultra-high voltage insulation materials are mainly imported, the localization of 220kV and above cross-linked polyethylene ultra-clean insulation materials is booming, and the localization of high-voltage DC cable materials has made certain progress.

Polyethylene material

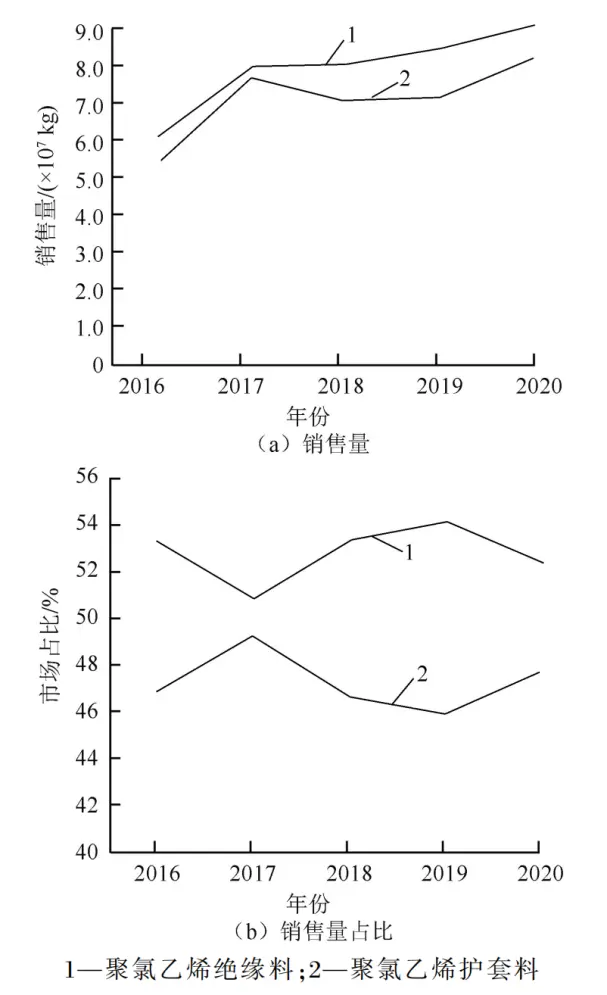

Polyethylene insulation materials in the cable industry are mainly used for communication cables. Polyethylene insulation materials have good dielectric properties and can meet the low attenuation and low capacitance requirements of communication cables such as data cables, railway signal cables, radio frequency cables and TV cables. The sales volume and share of polyethylene in 2016-2020 are shown in Figure 4.

Figure 4 Polyethylene sales volume and its share from 2016 to 2020

As shown in Figure 4, the number of manufacturers and market size of polyethylene sheathing materials are currently stabilizing, while the development of polyethylene sheathing materials was previously differentiated. The use of pure black polyethylene sheathing materials has decreased. The communication optical cable product market generally uses recycled modified polyethylene sheathing materials, and plans to formulate standards to assess their performance and quality. There is a great development in a variety of flame-retardant polyethylene sheathing materials used for the sheaths of communication cables, optical cables, and power cables, such as flame-retardant polyethylene sheathing materials, high elongation flame-retardant polyethylene sheathing materials, anti-cracking flame-retardant polyethylene sheathing materials, rat-ant-proof flame-retardant polyethylene sheathing materials, etc., which have all been successfully developed and promoted for use.

Polyvinyl chloride material

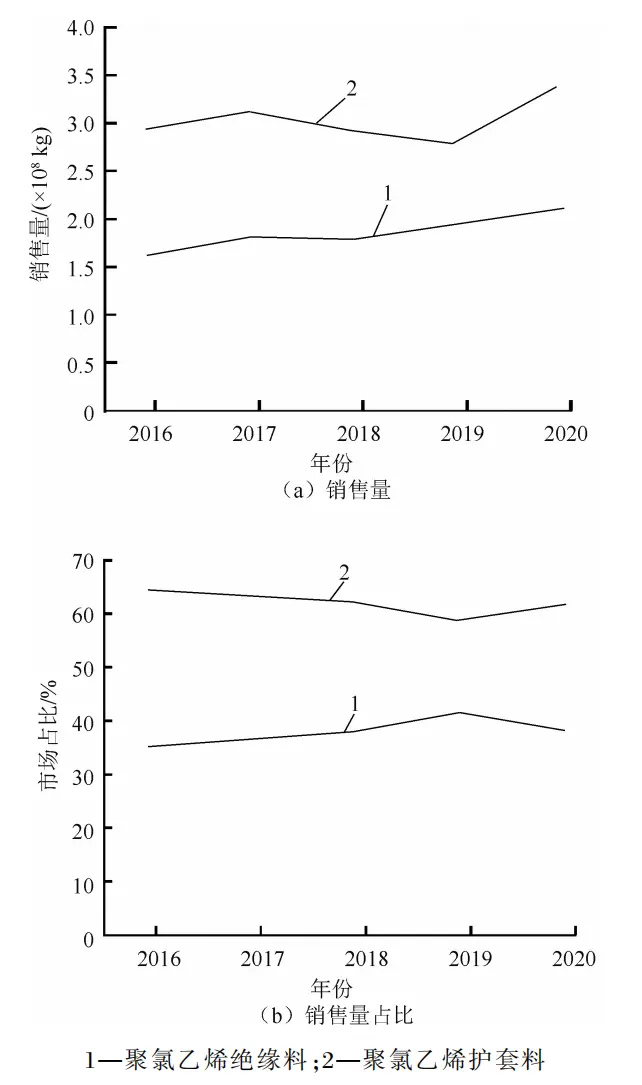

At present, the growth of PVC materials is mainly in special fields such as insulation materials for automotive wires, elastomers for elevator cables, and PVC materials for communication optoelectronic hybrid cables. Low-smoke and low-halogen PVC sheath materials for power cables have also been promoted and applied. From 2016 to 2020, the sales volume and proportion of PVC insulation and sheath materials are shown in Figure 3.

Figure 3 Sales volume and share of PVC insulation and sheath materials from 2016 to 2020

As shown in Figure 3, by 2020, the output of PVC cable materials is above 1.0x10¹¹kg, and the equipment capacity of cable material enterprises is above 1.5x10¹¹kg, which is far greater than the market demand. In recent years, the total output of PVC cable materials has increased, but with the increasing demand for safe, environmentally friendly, low-smoke and halogen-free cables in major projects or important occasions, the demand for PVC cable materials will decrease.

Analysis on changes in overall market demand for cable materials

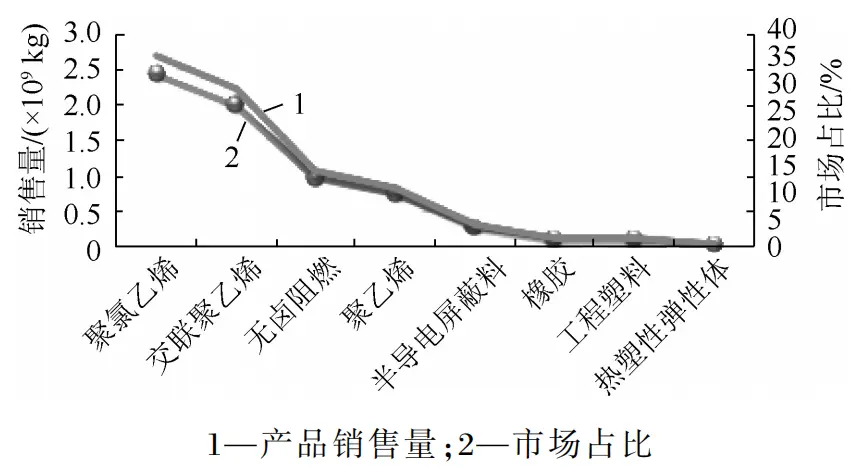

Cable materials can be divided into plastics and rubbers in terms of major categories. Among them, commonly used plastics are polyvinyl chloride, polyethylene, cross-linked polyethylene, low-smoke halogen-free flame retardant materials and semi-conductive shielding materials; commonly used rubbers are ethylene-propylene rubber, chlorinated polyethylene and silicone rubber (including fire-resistant silicone rubber). From 2016 to 2020, the total sales volume and market share of seven types of cable materials products of the surveyed companies, including polyvinyl chloride, cross-linked polyethylene, halogen-free flame retardant cable materials, polyethylene, semi-conductive shielding materials, rubber and engineering plastics, are shown in Figure 1.

Figure 1 Total sales volume and market share of seven categories of cable materials from 2016 to 2020

In 2020, the sales volume of plastics was about 3.2X10⁹kg; the sales volume of rubber was about 1.5X10⁸kg; the sales volume of special materials such as thermoplastic elastomers, fluoroplastics and nylon accounted for a very small proportion.

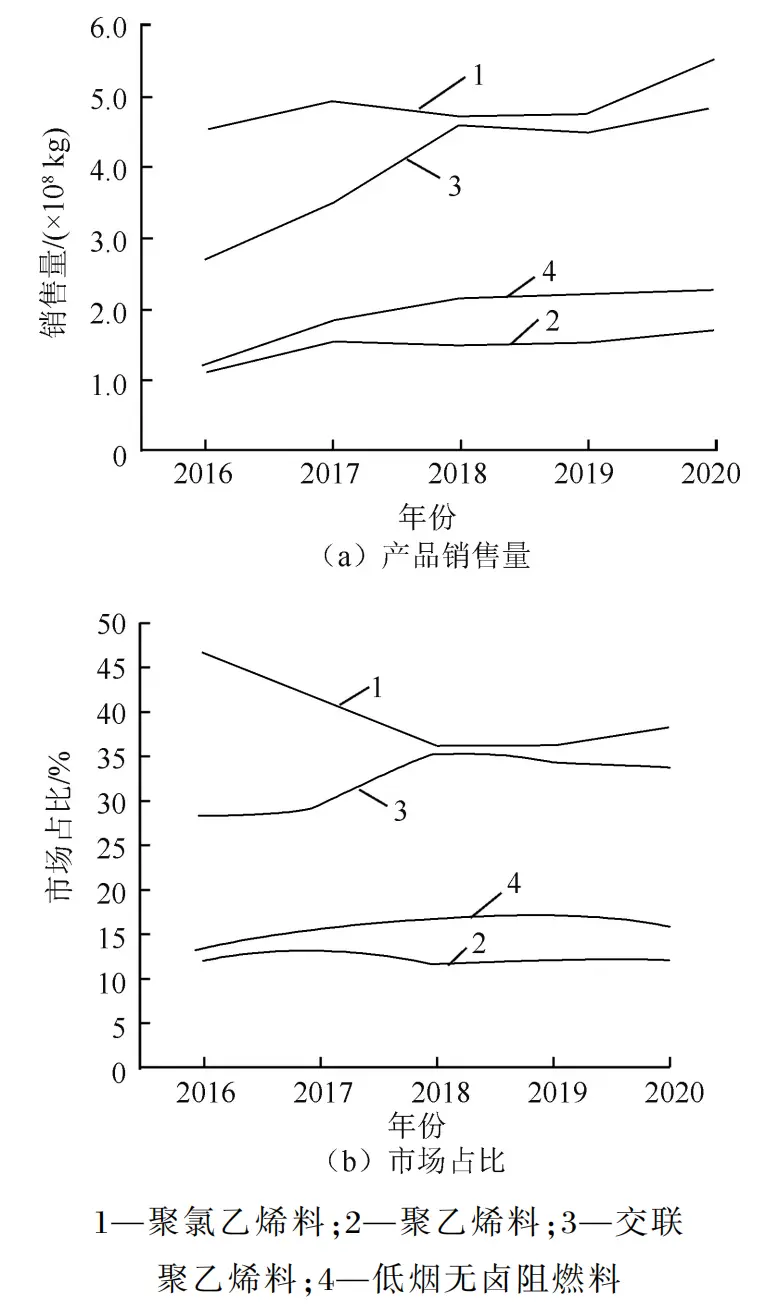

Since semi-conductive shielding materials are mainly used in medium and high voltage power cables, their application range cannot cover all cable varieties. Therefore, the analysis of the market demand changes of four major cable materials, namely polyvinyl chloride, polyethylene, cross-linked polyethylene and low-smoke halogen-free flame retardant, can represent the overall market demand changes of cable materials to a certain extent. The sales volume and market share of the four major material products from 2016 to 2020 are shown in Figure 2.

Figure 2 Sales volume and market share of four major material products from 2016 to 2020

As can be seen from Figure 2, from 2016 to 2020, the sales volume of four main materials, namely polyvinyl chloride materials, polyethylene materials, cross-linked polyethylene materials and low-smoke halogen-free flame retardant materials, increased year by year, from 9.6x10⁸kg in 2016 to 1.42x10⁹kg in 2020, an increase of 48%, with an average annual compound growth rate of about 8%.

For polyvinyl chloride materials, the sales volume in 2016 was 4.5x10⁸kg, accounting for 47% of the market; the sales volume in 2020 was 5.4x10⁸kg, accounting for 38% of the market, with an average annual compound growth rate of approximately 4.6%.

For polyethylene materials, the sales volume in 2016 was 1.1x10⁸kg, accounting for 12% of the market; the sales volume in 2020 was 1.7x10⁸kg, accounting for 12% of the market, with an average annual compound growth rate of approximately 9.1%.

For cross-linked polyethylene materials, the sales volume in 2016 was 2.7x10⁸kg, accounting for 28% of the market; the sales volume in 2020 was 4.8x10⁸kg, accounting for 34% of the market, with an average annual compound growth rate of approximately 12%.

For low-smoke halogen-free flame retardant materials, the sales volume in 2016 was 1.2x10⁸kg, accounting for 13% of the market; the sales volume in 2020 was 2.2x10⁸kg, accounting for 16% of the market, with an average annual compound growth rate of approximately 12.8%.

As of 2020, the total sales volume of major materials from high to low are polyvinyl chloride materials, cross-linked polyethylene materials, halogen-free flame retardant materials and polyethylene materials; the average annual compound growth rates from high to low are low-smoke halogen-free flame retardant materials, cross-linked polyethylene materials, polyethylene materials and polyvinyl chloride materials.

Although polyvinyl chloride is still the main material in the industry, its sales growth rate is much lower than that of cross-linked polyethylene and low-smoke halogen-free flame retardant. The sales volume of polyvinyl chloride relative to cross-linked polyethylene increased from 1.6 times in 2016 to 1.1 times in 2020; the sales volume of polyvinyl chloride relative to low-smoke halogen-free flame retardant increased from 3.6 times in 2016 to 2.3 times in 2020. The changes in sales volume of major material products from 2016 to 2020 reflect the obvious differences in the market development potential of the four major materials.

High-voltage direct current (HVDC) cable industry front-end enterprises:

Nexans SA

C-EPRI Electric Power

Engineering Co Ltd

Prysmian Group

NR Electric Co Ltd

Schneider Electric

Siemens AG

HVDC Technologies Ltd

NKT A/S

ABB Ltd

Mitsubishi Electric Corporation

American Superconductor Corp

Toshiba Corporation

Sumitomo Electric industries Ltd

Product category breakdown:

Between 501 MW and 2000 MW,

2001 MW

Up to 500 MW

Downstream application market:

Grid suppliers

Power/Generation Companies

Power/Transmission Companies other